This is a subject I think a lot of people are not sure about but are afraid to ask so I’ll point out a few things to consider when building your pricing.

Overhead – Overhead is pretty common so I’m not going to discuss it too much. The one thing I will point out is overhead should not be an arbitrary percentage you add to all your pricing. It would be calculated based on operating costs and forecasting. It should be re-calculated at least annually.

General & Administrative (G&A) – Small businesses generally lump G&A into their Overhead calculations. Some companies choose to separate G&A and OH. G&A is your cost of doing business such as rent, utilities and insurance. OH typically covers your staff positions that don’t charge directly to a contract, such as receptionist, CEO and other overall positions.

Margin (Profit) – Margin is the percentage you add to the overall project. I have seen markup on products as high as 50%, but those are usually achievable when you have the market cornered and the government has no choice but to buy from you. For services, a typical margin is about 15%. Remember, bidding is competitive so you need your price to be lower than your competitor’s.

Price Breakdown – Depending on the type of the contract, the government can ask you to provide a breakdown of your pricing. You don’t have to get overly detailed in the price breakdown, but they are general interested in 2 parts of your pricing. 1. They are typically looking to see what material is driving the cost and lead-time. 2. They want to see you margin. That is the only part of your pricing the government can really ask you to negotiate. If you’re providing services they have an unwritten target of negotiating your margin down to 15%.

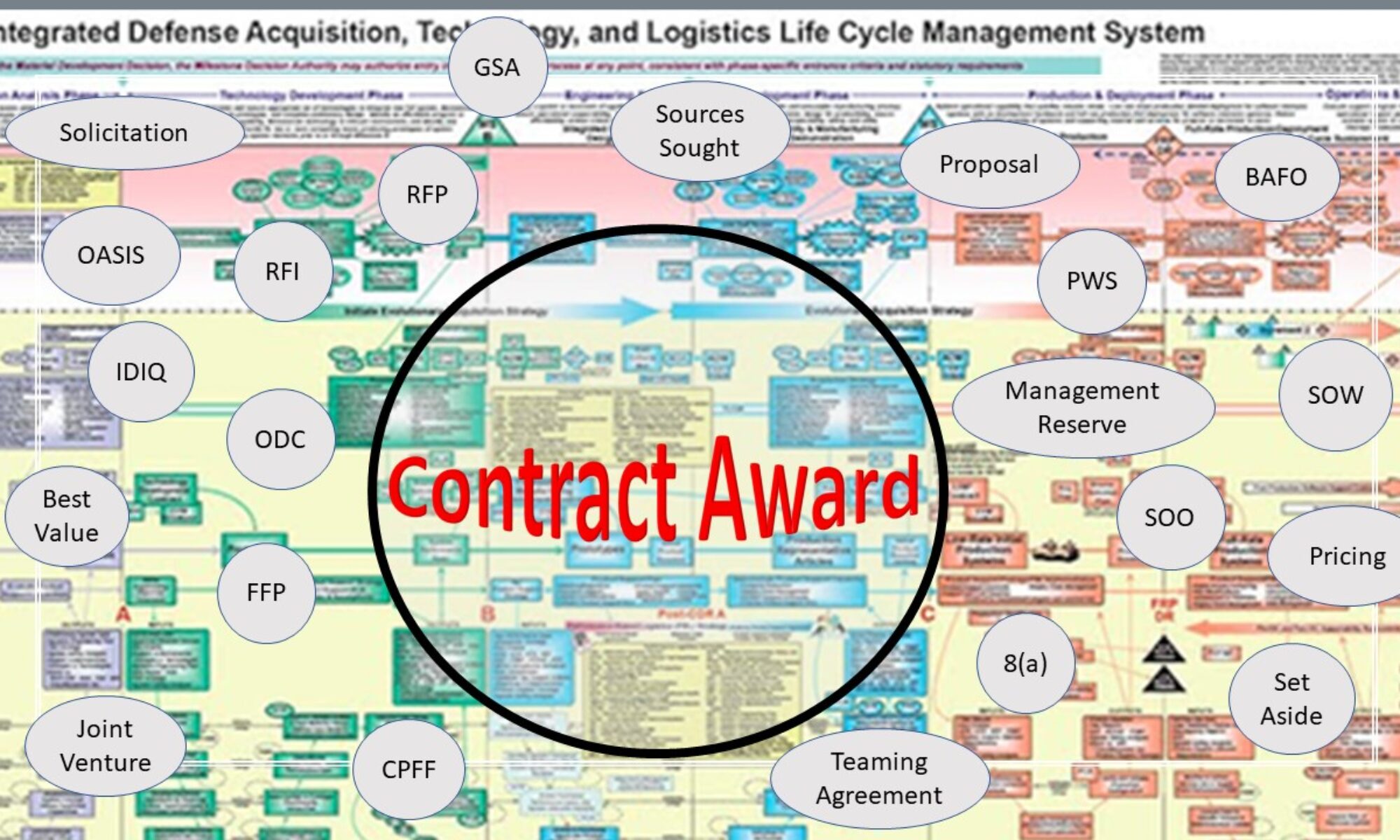

Management Reserve – Management Reserve is a small fund that most sr. managers and company executive would not like me talking about. Management Reserve is a small percentage or fixed amount of funding a manager at the execution level of the project sneaks in to give himself a small cushion if something goes wrong and he gets into a price overrun situation. If you don’t use it your company will enjoy increased margin and you’ll be a hero for completing the project underbudget.

Of course you could spend a lot of time discussing pricing. Just remember government contracting is very competitive so Low-Price-Technically-Acceptable (LPTA) is who will win so you need to make sure your pricing is accurate and complete. You can’t afford to forget to include something in your pricing. A big mistake small businesses make is underestimating the level of effort for program management and the requirements for the data package. Be careful.